What Is Cryptocurrency?

Cryptocurrency is a type of digital money that exists only online. Unlike traditional currencies like the Australian dollar (AUD), it isn’t printed or controlled by a government or bank. Instead, it uses a technology called blockchain to record transactions and keep everything secure and transparent. You might have heard of some popular cryptocurrencies like Bitcoin or Ethereum, these are just a couple of the many types out there.

The idea behind cryptocurrency is to let people send and receive money directly, without needing a bank in the middle. So if you wanted to pay a friend for dinner, you could send them some cryptocurrency straight from your phone. The blockchain keeps track of that transaction, so no one can cheat the system or spend the same money twice.

One of the main reasons people are interested in crypto is that it’s decentralised, which means no single person, company, or government controls it. This appeals to some Aussies who want more independence over their money or want to invest in something different. But it’s important to know that cryptocurrencies can be highly volatile, meaning their value can go up and down quickly. Like any investment, they carry risk, so it’s wise to do your research and never put in more than you’re willing to lose.

In Australia, crypto is legal, and the Australian Taxation Office (ATO) treats it like property for tax purposes, meaning you may need to pay capital gains tax when you sell or trade it. If you’re just getting started, it’s a good idea to learn the basics and perhaps try a small, reputable exchange to explore how it works.

Is Crypto Real Money?

That’s a common question, and the answer depends on how you look at it. Cryptocurrency isn’t “money” in the traditional sense, like Aussie dollars you can hold in your hand and wallet. But it can be used to buy things, especially online, and some businesses even accept it as payment. People also use it to send funds across borders or invest in the hope that its value will grow. So while it’s not legal tender in Australia, it does have real value and real-world uses – so yes, in many ways, crypto is real money.

How Do You Buy Cryptocurrency?

Buying crypto in Australia is pretty straightforward. You start by signing up with a crypto exchange, think of it like a website or app where you can trade Aussie dollars for digital coins. Some well-known Australian exchanges include Swyftx, CoinSpot, and Independent Reserve, while international ones like Coinbase or Binance are also popular.

Once your account is verified (you’ll need to upload ID, just like opening a bank account), you can deposit AUD via bank transfer, card, or PayID. Then, you can buy a cryptocurrency like Bitcoin, Ethereum, or whatever you’re curious about. Many exchanges offer beginner-friendly apps, so you don’t need to be tech-savvy to get started.

Spending Crypto Like Cash – With a Crypto Debit Card

You don’t have to just hold onto your crypto and watch the prices; these days, you can actually spend it just like cash. Some crypto exchanges now offer debit cards that let you use your Bitcoin, Ethereum, or other coins to pay for everyday things like groceries, coffee, or online shopping.

These crypto debit cards work much like your regular bank card. When you tap or swipe, the card converts your crypto into Aussie dollars on the spot. Pretty handy, right?

A few popular options available to Aussies include:

- Crypto.com Visa Card – offers cashback in their token (CRO) and works globally.

- CoinJar Card – an Aussie-based card you can use anywhere Mastercard is accepted.

- Binance Card – works for international purchases and lets you spend multiple types of crypto.

These cards often come with rewards, low fees, and mobile apps to track your spending, but make sure you check the fine print, because exchange rates, limits, and tax implications can apply.

Is Crypto Safe?

Like anything involving money, there are risks, but there are also ways to protect yourself. The technology behind crypto, especially blockchain, is very secure. But crypto exchanges and wallets can be hacked, or you might fall for scams if you’re not careful.

Here are a few safety tips:

- Use trusted exchanges and DIY research.

- Turn on two-factor authentication for your account.

- Store large amounts in a hardware wallet (a secure device not connected to the internet).

And remember, the value of crypto can rise and fall sharply, so it’s best to start small and never invest more than you’re comfortable losing. For Aussies new to it, taking the time to understand the basics can go a long way in helping you stay safe and make informed choices.

🚨 The Risk of Buying at the Peak and Panic Selling

Cryptocurrency markets are known for their volatility. It’s common for prices to surge during periods of hype, often fueled by news coverage and social media buzz. During these times, many new investors are drawn in, fearing they’ll miss out on potential gains. However, entering the market during these peaks can be risky.

Consider this scenario: an investor buys Bitcoin when it’s at a high point, say around $100,000, driven by the excitement and fear of missing out. If the market then experiences a downturn, and Bitcoin’s price drops to $70,000, the investor faces a significant paper loss. Panicking, they might sell their holdings to prevent further losses. This behaviour, buying high and selling low, is the opposite of the ideal investment strategy and can lead to substantial financial setbacks.

Such patterns have been observed in past market cycles. For instance, after reaching highs in late 2017, Bitcoin’s price plummeted in 2018, catching many late investors off guard. Similarly, significant price corrections have followed other rapid surges, emphasising the importance of cautious and informed investing.

📈 Bitcoin Investment Returns Over Time

To illustrate Bitcoin’s performance over different time frames, let’s examine hypothetical investments of $100 made on May 15 in previous years, compared to its price on May 15, 2025:

- 1 Year Ago (May 15, 2024):

- Price: $66,267.49

- Current Price: $103,794.65

- Return: Approximately $156.56

- 5 Years Ago (May 15, 2020):

- Price: $9,328.20

- Current Price: $103,794.65

- Return: Approximately $1,112.79

- 10 Years Ago (May 15, 2015):

- Price: $237.61

- Current Price: $103,794.65

- Return: Approximately $43,688.65

Note: These figures are based on historical data and are for illustrative purposes only. Past performance is not indicative of future results.

These examples highlight Bitcoin’s significant growth over the past decade. However, it’s crucial to remember that such returns come with high volatility and risk. Investors should conduct thorough research and consider their risk tolerance before investing in cryptocurrencies.

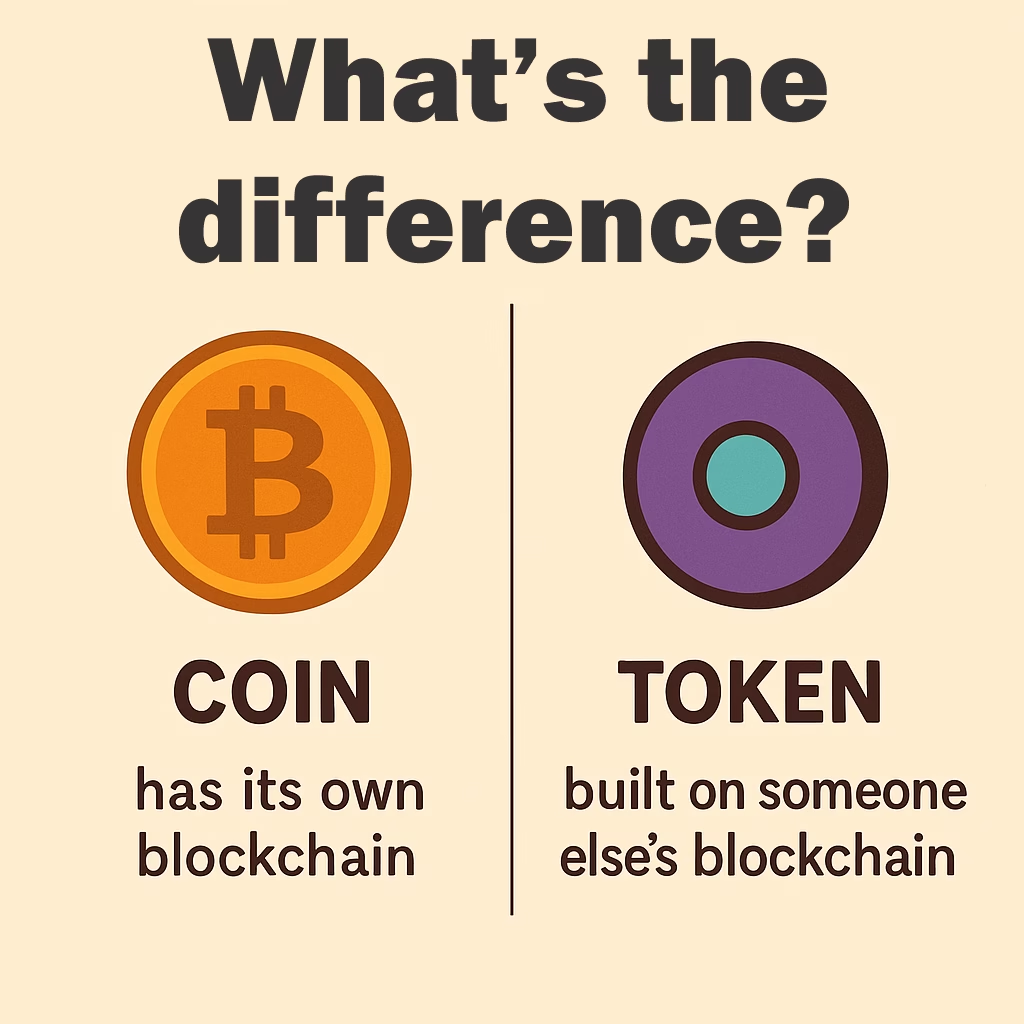

What’s the Difference Between a Coin and a Token?

Alright, so you’ve probably heard the terms “coin” and “token” thrown around in the crypto space, and while they sound similar, there’s a pretty easy way to tell them apart.

Coins, like Bitcoin (BTC) or Ethereum (ETH), run on their own blockchain. Think of a blockchain like a digital highway, and coins are the main vehicles cruising along that road. Bitcoin uses the Bitcoin blockchain, and Ethereum runs on the Ethereum blockchain; they’re the original currencies for those networks. These coins are usually used like digital cash: to pay, trade, or store value.

Now, tokens are a bit different. They don’t have their own blockchain. Instead, they’re built on top of another blockchain, usually Ethereum. So a token is like a passenger hopping on someone else’s highway. For example, popular tokens like Chainlink (LINK) or Uniswap (UNI) use the Ethereum network to work.

Tokens can do heaps of things, some represent ownership (like shares in a project), some are used in games or apps, and others act like loyalty points or access passes.

TL;DR:

- Coin = has its own blockchain (e.g. Bitcoin, Ethereum)

- Token = built on someone else’s blockchain (e.g. most things running on Ethereum)

So when you’re starting out, just remember: coins are like the main currency of their own system, and tokens are like apps or tools that run within a bigger system.

Backing Loans with Bitcoin in Australia

Another exciting development is how some finance and lending companies in Australia are now accepting Bitcoin as collateral for loans. That means you can use your crypto holdings to back a loan without having to sell your coins.

This can be useful if you’re looking to access cash for something like a car, business investment, or even a home deposit, but you don’t want to offload your Bitcoin (especially if you believe it’ll keep rising in value).

Companies like:

- Helio Lending

- Nexo (international but services Aussies)

- Block Earner (working with DeFi and yield-based crypto products)

…are some examples offering crypto-backed lending in Australia. Just keep in mind: if the value of your Bitcoin drops too far, the lender might ask you to add more collateral, or they could sell some of your crypto to cover the loan. So, it’s a good idea to fully understand the risks before diving in.

Interested to learn what powers all of this? Check out this post, all about Blockchain.

So, we’ve covered what crypto is, how you can buy it, the difference between coins and tokens, and the risks of jumping in during news and social media hype. We’ve looked at how much Bitcoin has grown over the years, how you can spend it using crypto debit cards just like cash, and even how Aussie lenders are now backing loans with Bitcoin as collateral. With all this real-world use and growing adoption, you’ve got to ask yourself, does this still sound like a scam, or is it just a new kind of money the world’s still getting used to?

Firstly, for those who don’t know me, I’m Scott, the driving force behind DeFi Life, where we’re revolutionising how Australians approach decentralized finance (DeFi) and the Education around it.