The crypto world offers a variety of ways to trade, invest, and earn, but one of the most fundamental choices you’ll make is between centralised and decentralised exchanges. Whether you’re a beginner or already deep into DeFi, understanding this distinction is key to managing your portfolio and unlocking passive income streams.

Let’s break down the difference.

Centralised Crypto Exchanges (CEX): The Gatekeepers

Centralised exchanges are platforms operated by a company or organisation that acts as an intermediary for crypto trading. Think of them like traditional stock exchanges for crypto.

Key Features:

- Custodial: The exchange holds your crypto until you withdraw.

- KYC/AML: Users must usually verify their identity.

- Easy UX: Ideal for beginners.

- Faster transactions, but often limited control over your funds.

Examples:

- Binance – One of the largest and most popular CEXs in the world, offering a wide range of crypto assets and services, including staking, futures, and a launchpad for new tokens.

- Coinbase – A user-friendly platform based in the U.S., well-regarded for its security and regulatory compliance. It’s often the go-to for crypto newcomers.

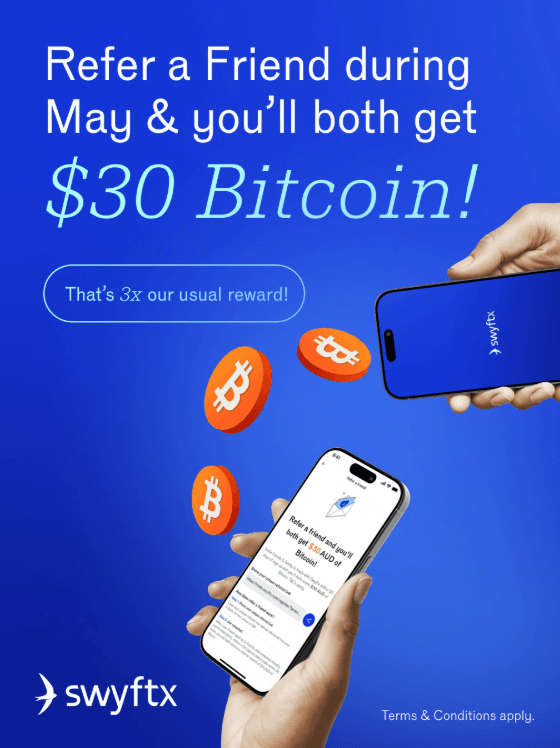

- Swyftx – Australian-based. They will give you newcomers $30 worth of Bitcoin once you are verified, have made any size fiat deposit, and have traded. Get on this if you’re new, link below. (DM me if you need help)

Decentralised Crypto Exchanges (DEX): Power to the People

Decentralised exchanges are peer-to-peer marketplaces where transactions occur directly between users via smart contracts, no middleman needed.

Key Features:

- Non-custodial: You retain full control of your crypto.

- Anonymous: No KYC requirements.

- Permissionless: Anyone can list tokens or trade.

- Ideal for DeFi strategies like yield farming and liquidity provision.

Examples:

- Uniswap – Built on Ethereum, Uniswap allows users to swap ERC-20 tokens using liquidity pools. It’s the blueprint for most DEXs that followed.

- Apertum DEX – A newer decentralised exchange tailored for the Apertum ecosystem. It supports multi-chain assets and features native liquidity pools.

Passive Income with DAO1 and Apertum

Now, let’s explore how DAO1 and Apertum Coin can be used to earn passive income through a DEX like Apertum DEX.

1. Providing Liquidity

You can earn a share of trading fees by adding USDT and Apertum Coin to a liquidity pool on Apertum DEX. Here’s how:

- Go to the liquidity section on Apertum DEX.

- Select the USDT/Apertum trading pair.

- Supply an equal value of both tokens to the pool.

- Earn a percentage of fees from every trade that uses your liquidity.

This is ideal for long-term holders who want to earn yield instead of letting tokens sit idle.

Passive Income via Staking

Staking Ethereum and Solana through a Ledger hardware wallet allows users to earn passive income while maintaining control over their crypto assets. By delegating their tokens to a validator directly from the Ledger device using interfaces like Ledger Live (for Ethereum via Lido or Rocket Pool) or third-party apps like Solflare (for Solana), users contribute to the security and operation of these decentralized networks. Staking is decentralized because it relies on a distributed network of validators rather than centralized entities. Anyone meeting the technical and financial requirements can become a validator. This ensures that no single party controls the network. With a Ledger wallet, users retain self-custody, meaning their private keys never leave the device, offering enhanced security while still participating in decentralized staking.

Final Thought

Whether you’re just dipping your toes into crypto or already knee-deep in DeFi, knowing the difference between CEXs and DEXs helps you take control of your assets and earning potential. If you value privacy, control, and community governance, decentralised exchanges like DAO1 and Apertum DEX, paired with tokens like wUSDT and Apertum Coin, offer an exciting path to passive income.

Start small, learn the ropes, and let your crypto work for you.

Always open for a chat, socials below, send me a DM.

Firstly, for those who don’t know me, I’m Scott, the driving force behind DeFi Life, where we’re revolutionising how Australians approach decentralized finance (DeFi) and the Education around it.